Share

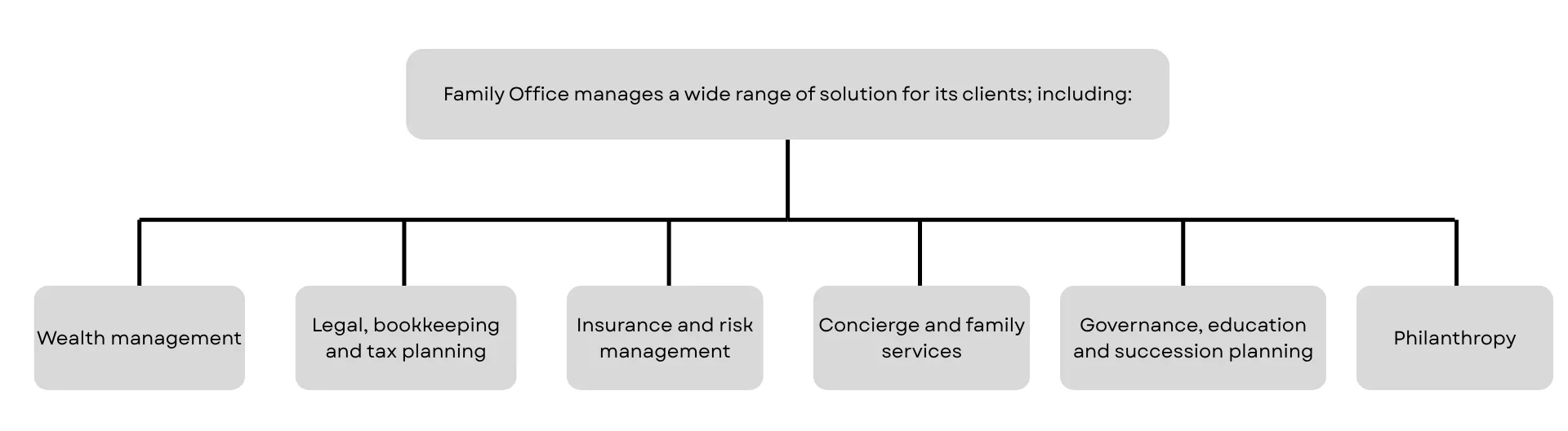

A Single Family Office (SFO) is a private entity established to manage wealth, assets, succession, and related affairs of one family, offering tailored services such as investment management, tax and legal structuring, estate planning, philanthropy, and governance.

The Malaysian government has recently introduced the Single Family Office incentive Scheme to attract high-net-worth families and strengthen the local wealth management ecosystem. Under this scheme, a family may set up a Single Family Office Vehicle (SFOV) in the Forest City Special Financial Zone, Johor, and enjoy many tax incentives and benefits.

Source: https://www.sc.com.my/development/single-family-office

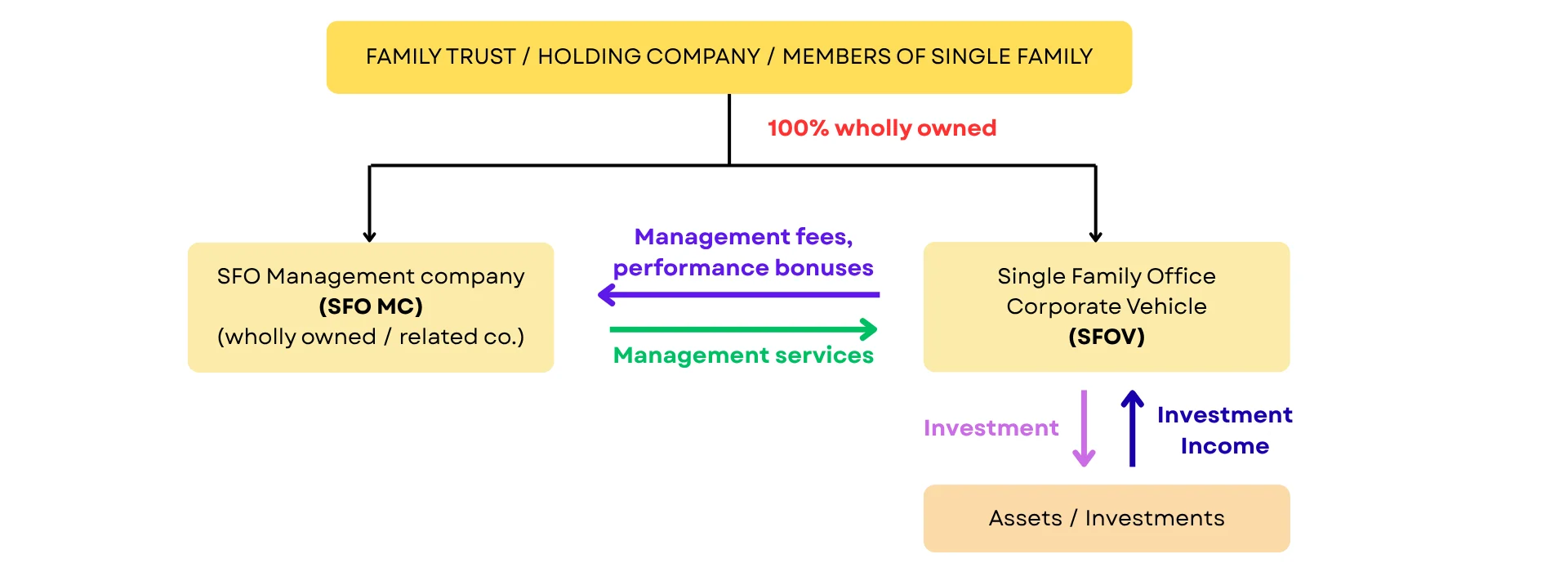

Single Family Office Vehicle (SFOV) is a new company incorporated under the Companies Act 2016 which is wholly owned, directly or indirectly, by one or more individuals, all of whom are members of a single family. In addition, the vehicle has to be operating in Pulau 1 of the Forest City Special Financial Zone and established solely for the purpose of holding assets and investments for the interests of members of a single family.

The Single Family Office Management Company is a Malaysian company wholly owned, directly or indirectly by the members of a single family and established for the purpose of managing the assets and investments for the interest of members of the single family.

Requirements for SFO MC includes all AUM to be managed out of Malaysia by SFO MC and SFOV. Although investment for the 90% of the AUM can be done overseas, it must be managed with or by related companies and can be delegated to fund managers licensed by the Securities Commission (SC).

| Criteria | SFOV | SFO MC |

| Tax Incentives |

|

Special individual income tax rate of 15% for knowledge workers and Malaysians working in Forest City SFZ (FCSFZ) |

| Form of Legal Entity |

|

|

| Licensing | Two-step process for SFO Incentive Scheme Certification:

|

A fund management license under the Capital Markets and Services Act 2007 (CMSA) is required.

|

| Assets Under Management

(AUM) |

|

All AUM in the SFOV to be managed by the SFO |

| Substance Requirement |

|

|

| Annual Spending | Incur at least RM500,000 local spending | N/A |

| Criteria | SFOV | SFO MC |

| Substance Requirements | Minimum four Full Time Employee in SFOV | N/A |

| Assets Under Management (AUM) |

|

Same as Initial Period |

| Annual Spending | Incur at least RM650,000 local spending | N/A |

Notes:

Bank Negara Flexibility on Foreign Exchange Policy

In addition to tax incentives, the Central Bank of Malaysia (Bank Negara Malaysia) provides foreign exchange administration flexibilities tailored to facilitate cross-border capital flows. These flexibilities are granted for an initial five-year period, renewable subject to compliance.

Under this policy, it allows for SFOVs to have no limit on offshore borrowings, no limit on investments in FCY assets allowing for investments of any amount in FCY assets onshore and abroad, provided that funds for investments are sourced from non-residents or abroad. The example of the eligible sources of funds includes but not limited to:

It is important to note that only family offices planning to actively invest abroad beyond the standard permissible limit (currently RM50 million per annum for entities with domestic ringgit borrowings) may apply for these flexibilities, as those with smaller annual transaction size can already invest abroad within the current limit.

The introduction of Single Family Office (SFO) incentives in Malaysia reflects the government’s commitment to positioning the country as a competitive wealth management hub in the region. By offering attractive tax exemptions, foreign exchange flexibilities, and a clear regulatory framework, Malaysia provides high-net-worth families with a secure and efficient platform to manage, preserve, and grow their wealth across generations. However, SFOs must also ensure strict compliance with the stipulated requirements on structure, operations, and reporting to fully enjoy these benefits. With the right governance and planning, establishing an SFO in Malaysia can be a strategic choice for families seeking wealth sustainability.

For more information regarding Single Family Office in Malaysia kindly refer to: https://www.sc.com.my/development/single-family-office

Privacy Settings

We use cookies to improve your browsing experience, to provide personalised ads or content and to analyse our traffic. If you click on "Accept All", you agree to the use of cookies.

Cookie Usage

We use cookies to help you navigate our site smoothly and to support key functions. “Necessary” cookies are always active as they enable basic features. We also use third-party cookies to analyse usage, remember your preferences, and deliver relevant content. These cookies will only be stored with your consent. You may enable or disable them at any time, but doing so could impact your browsing experience.