E-Invoicing Implementation

What is e-Invoicing?

E-Invoice is a digital representation of a transaction between a supplier and a buyer, replacing traditional paper-based or electronic documents such as invoices, credit notes, and debit notes.

An e-Invoice includes all the essential information found in conventional documents—such as supplier and buyer details, item descriptions, quantity, price (excluding tax), applicable taxes, and the total amount—serving as a standardized record of transaction data for daily business operations.

To modernize tax administration and enhance compliance, the Inland Revenue Board of Malaysia (IRBM) has introduced the e-Invoice regime, effective 1 August 2024, through a phased implementation approach to facilitate a smooth transition for businesses of all sizes.

Is your business required to comply with the e-Invoicing regime?

According to the IRB, all persons in business are required to comply with the e-Invoicing regime.

Business-to-Business (B2B) Transactions | Transactions between businesses |

Business-to-Consumer (B2C) Transactions | Transaction between businesses and end consumers |

Business-to-Government (B2G) Transactions | Transaction between businesses and government entities |

Overview of the e-Invoice model

To facilitate the transition to e-Invoice, the IRBM has allowed taxpayers the option to select the most suitable mechanism to transmit e-Invoices towards the IRBM.

There are 2 options provided for e-Invoice transmission mechanisms for taxpayers selection:

- MyInvois Portal

- A portal hosted by the IRB

- Accessible to all taxpayers at no cost

- Also accessible to taxpayers who need issue e-Invoice where Application Programming Interface (API) connection is unavailable

- Application Programming Interface (API)

- API is a set of programming code that enables direct data transmission between taxpayers’ system and the IRB MyInvois system

- Requires upfront investments in technology and adjustments to the taxpayers’ existing system

- Ideal for taxpayers or businesses with large transaction volumes

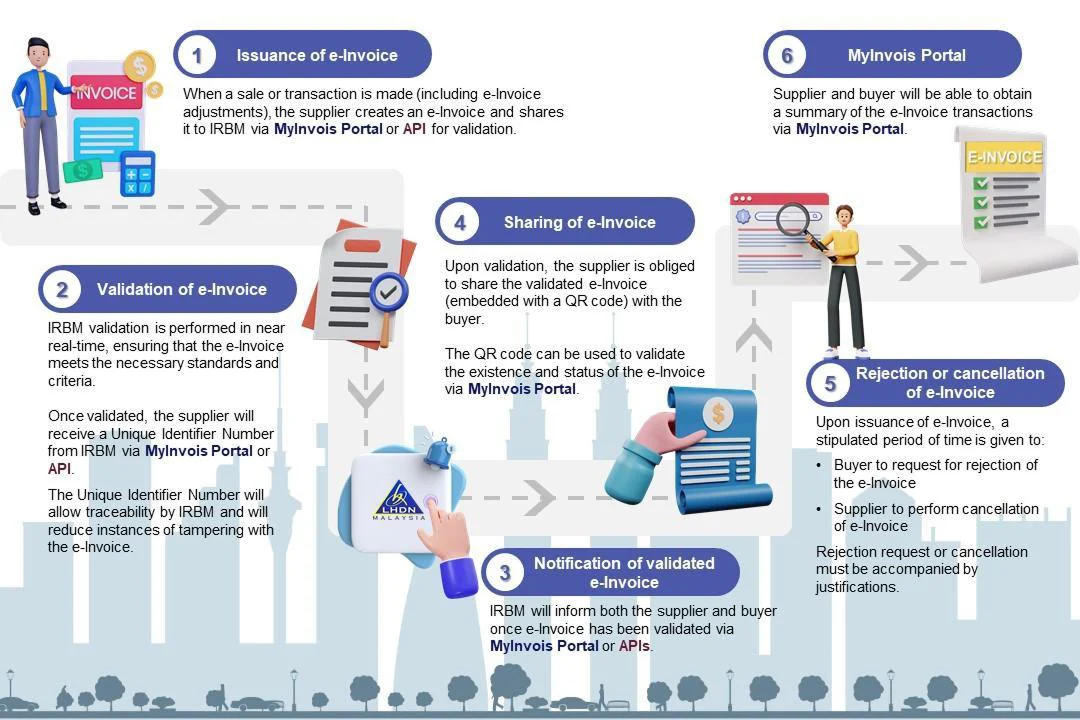

E-Invoice Workflow:

Source: LHDN

The e-Invoice Implementation Timeline

The IRB has announced that the e-Invoice regime will be implemented in a phased approach. The e-Invoice regime implementation timeline as of 5 June 2025:

Phase | Targeted Taxpayers | Implentation Timeline |

1 | Taxpayers with an annual turnover or revenue of more than RM100 million | 1 August 2024 |

2 | Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million | 1 January 2025 |

3 | Taxpayers with an annual turnover or revenue of more than RM 5 million and up to RM25 million | 1 July 2025 |

4 | Taxpayers with an annual turnover or revenue of more than RM1 million and up to RM5 million | 1 January 2026 |

5 | Taxpayers with an annual turnover or revenue of up to RM1 million | 1 July 2026 |

The IRB has granted taxpayers a six (6) month grace period from the respective mandatory e-Invoice implementation dates to ease the transition and reduce compliance burden. Additionally, the exemption threshold has been increased to RM500,000 in annual turnover, up from the previously announced RM150,000, providing relief to more small businesses.

How we can help

At ECOVIS Malaysia, we assist businesses in navigating the e-Invoice implementation process with confidence and ease. Our team conducts a comprehensive readiness assessment to evaluate your existing systems and identify any compliance gaps. We help you plan and implement the necessary changes, including integration with the IRB’s MyInvois platform, while ensuring your internal processes are aligned with the new requirements. In addition, we provide tailored training for your finance and operations teams, ensuring they understand and can manage the e-Invoice process effectively. Our ongoing support ensures your business stays compliant with the latest developments and regulatory updates, helping you achieve a seamless and successful transition.